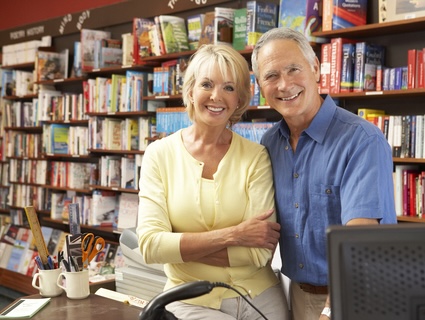

Older active adults with energy, interests, and skills may have an entrepreneurial itch. Diane Harris, deputy editor at Kiplinger Personal Finance magazine, offers tips for starting a successful business in the golden years.

Here’s a quick pop quiz: What do Ray Kroc, Colonel Sanders, Arianna Huffington, Bernie Marcus and Grandma Moses have in common? Answer: They all launched highly successful businesses — McDonald’s, KFC, a major media company, The Home Depot and a career as a preeminent folk-art painter — after age 50.

Like these icons, a growing number of people are choosing to become entrepreneurs in their 50s, 60s, and beyond. Recently, nearly one-fourth of new businesses have been started by founders between the ages of 55 and 64, up from 15% two decades ago, according to the Kauffman Foundation, a nonprofit that fosters entrepreneurship. Overall, the U.S. Census Bureau reports, more than half of small businesses are owned by people 55 and older, with other surveys suggesting the number may be even higher.

Starting a business after 50 can be a great way to add years to your career or earn extra income in retirement. And while the chances you’ll strike it rich by creating a top-selling fast-food franchise or a multibillion-dollar retail operation are slim, your odds of doing well are far greater than for younger founders. Research shows that people launching a business at age 50 are twice as likely to succeed as their 30-year-old counterparts and the probability of being solidly profitable rises further with age after that.

“The wisdom, experience and network built up over the course of a long career can really pay off for older entrepreneurs,” says Andrew Chamberlain, principal economist at Gusto, an online payroll and human-resources platform for small and midsize businesses.

Still, entrepreneurship is not without risks. That’s particularly true if you are giving up a steady income to launch your venture or pulling cash from a 401(k) for funding — at exactly the point in life that most people of a similar age are trying to pump up savings before retirement or preserve nest eggs they’ve already built.

“Launching a business can be a great move when you’re older, but it’s not an easy path,” says certified financial planner Jovan Johnson, co-owner of Piece of Wealth Planning, a financial planning firm in Atlanta that primarily serves small-business owners, private practitioners and independent contractors. “It takes the right mind-set, the right business and the right setup to succeed without sacrificing your current lifestyle or future retirement.”

Intrigued by the possibilities? Here’s what experts in entrepreneurship, along with people who have recently launched businesses, say it takes to achieve success.

Build on what you know

Just how much more successful are older entrepreneurs? Gusto’s research shows that baby boomers using its platform take home $60,000, on average, in their first year of operation. That’s six times as much as the $10,000 that Gen Z founders are able to pay themselves in year one, and it’s considerably more than millennial entrepreneurs’ first-year salaries as well.

Gusto’s Chamberlain attributes this greater profitability to older entrepreneurs’ deep experience in their industry, which allows them to better identify unfulfilled market needs. Some 44% of founders in a recent Gusto survey said they started a business precisely because they saw a new opportunity, compared with 34% of the respondents overall. “The longer you’re in a field, the more likely you are to see those unmet opportunities, which can be a strong basis for your business,” Chamberlain says.

If you launch a business when you’re older, you also have an edge because you’re likely to have a stronger business network, existing client relationships, and initial credibility and authority built through a long body of work. Says Chamberlain, “These are advantages that just come with age and a long career history.”

If you launch a business when you’re older, you also have an edge because you’re likely to have a stronger business network, existing client relationships, and initial credibility and authority built through a long body of work. Says Chamberlain, “These are advantages that just come with age and a long career history.”

“Utilizing the same skill set you’ve used throughout your career allows you to fast-track the new business,” adds Johnson. “It’s a very different proposition than if you’ve been an engineer or lawyer and now want to buy a food truck or open a restaurant.”

Building off his industry experience is what Rick Moore, 55, had in mind when he launched his consulting business, The RGM Group, in Colorado Springs last year. The former deputy chief of staff for plans and programs for the Air Force, Moore retired in 2024 after 32 years of service so that his son, then a rising eighth grader, could spend his high school years in the same place with the same group of friends. Now Moore, who had been responsible for the Air Force’s five-year budget and six- to 30-year plan, provides insights into the federal government’s budgeting process for companies that want to work with the Defense Department.

“I’ve been able to leverage the knowledge that I gained in the military to continue to serve the Air Force, helping small businesses get to a point where they can provide a much-needed service or product that helps airmen,” he says.

To Moore’s surprise and gratification, the consulting business has been a success from the start. He managed to build a client list quickly through referrals and cold calls to companies he thought would be a good fit. The $156 billion in mandatory defense funding passed by Congress over the summer has also been good for business. “Luck and timing are a part of all of these things, and mine happened to be good,” he says.

The greatest challenge so far? “In the military, I always knew what the near future held, and what my next paycheck would be; it was relatively certain and very secure,” he says. “I’m working harder and more than I thought I might when I worried I wouldn’t have enough business, but not harder and more than I desire. It’s the best problem to have.”

Do the (side) hustle

Sometimes you have little choice but to make a full-body leap into entrepreneurship. That may be the case if you are laid off from a job, still need to earn a living and have had trouble finding another staff position — something more likely to happen later in your career. One-fourth of entrepreneurs age 55 and older in the Gusto survey started their businesses due to job loss, compared with just 10% of founders on the platform overall.

But if you have the option to stay on at your current job and start your venture as a sideline business, experts say that’s typically the better way to go. You’ll keep money coming in while you’re getting the business off the ground, and you won’t have to dig into your savings to pay the bills until your business is profitable — if it becomes profitable. It also gives you time to test the idea, see what works and what doesn’t, and get a sense of whether you can really make a success of it while you still have a financial safety net.

“If you start small and learn the ropes while you’re still on someone else’s dime, it takes a lot of the fear and stress out of launching a business,” says Ross Buhrdorf, CEO of ZenBusiness, an online platform that provides a suite of services to help entrepreneurs create, manage and maintain their businesses. “Once it gets going and growing, you can progress into a full-time job. But don’t jump off the financial cliff first.”

The most important thing to learn during this sideline period, Buhrdorf says: “You need to make sure someone — actually, lots of someones — will pay you for what you are selling. It sounds so basic, but not knowing is the number one thing that will trip you up.”

Diane Harris is the deputy editor at Kiplinger Personal Finance magazine. For more on this and similar money topics, visit Kiplinger.com.

©2025 The Kiplinger Washington Editors, Inc. Distributed by Tribune Content Agency, LLC.

Read more inspiring articles on Seniors Guide:

Kelly Gunn: Vintage Vibes and a Bold Reinvention After 50