On Sept. 30, 2025, the federal government’s Social Security ends paper checks in favor of electronic transfers. If you or a loved one has been receiving paper checks, here’s how to make the switch.

The Social Security Administration will stop issuing paper benefit checks after Sept. 30, 2025. That includes Social Security and SSI (Supplemental Security Income provides cash aid to seniors over age 65 with limited income and resources and to people of any age with disabilities.)

After Sept. 30, payments will only be made electronically (through EFT, i.e., electronic funds transfer), either direct deposit to a bank or credit union or the Treasury’s Direct Express® Debit Mastercard.

The switch to EFT doesn’t apply only to Social Security recipients. The U.S. Treasury is completing a government-wide move to safer, faster, lower-cost EFT, as directed in President Trump’s Executive Order 14247, “Modernizing Payments To and From America’s Bank Account.” Agencies are required to pay electronically except for narrow, legally defined waivers.

The SSA website points to the convenience of EFT direct deposits: “You no longer have to stand in line to cash your check when it arrives. Your money goes directly into your account. You don’t have to leave your house in bad weather or worry if you’re on vacation or away from home. You don’t have to pay any fees to cash your checks. Your money is in your account ready to use when business opens the day you receive your check.”

Note that those who are applying for Social Security or SSI benefit must elect to receive their benefit payments electronically.

Who needs to act

If you still receive a paper check, you must pick an electronic option. If you already use direct deposit or Direct Express, you’re all set – no is action needed.

Your two choices

Before Social Security ends paper checks, people still receiving them need to choose from one of two ways to receive future funds.

Option 1: Direct deposit to a bank or credit union

With this option, the funds will be transferred directly into a bank account. The Social Security Administration recommends this option for its high level of security, the ease of signing up and then receiving the check monthly, and the convenience of not having to cash or deposit a check.

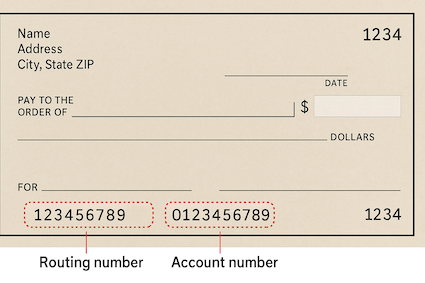

To make the change, gather your banking and account information before taking steps to complete the process. You’ll need the account type (i.e., savings or checking), routing number, and account number.

To make the change, gather your banking and account information before taking steps to complete the process. You’ll need the account type (i.e., savings or checking), routing number, and account number.

How to switch:

- Online: Sign in to My Social Security and start or change direct deposit. Sign in and follow the steps for “Direct Deposit.”

- By phone to the SSA: 1-800-772-1213 (TTY 1-800-325-0778).

- Through Go Direct: Follow the instructions at GoDirect.gov, where you can enroll online, make the switch by phone, or download and complete a direct deposit for to be mailed.

Option 2) Use the Direct Express® debit card

You don’t need a bank account for this option. It’s best for people who prefer a prepaid card or don’t have or want a bank account.

How to switch:

Enroll by calling Treasury’s Electronic Payment Solution Center (1-800-333-1795) or make the switch online at GoDirect.gov.

Other situations

If you live outside the U.S., contact the nearest Federal Benefits Unit (FBU) to set up electronic payments appropriate for your country.

If you’re a representative payee, managing someone else’s Social Security benefits, go to the SSA’s payee page at SSA.gov/payee.

In very rare circumstances, Treasury may grant exceptions to the electronic payment mandate, such as documented mental impairment, remote locations lacking electronic infrastructure, certain foreign-currency situations, or disaster areas. For more information or to request a waiver, call 855-290-1545. You may also print and fill out a waiver form and return it to the address on the form.

Watch out for scams

Seniors can be especially vulnerable to scams, which in many cases are targeted to them. SSA/Treasury will not call, text, or message you out of the blue to “verify” your bank info or threaten to cut off benefits. If you get a suspicious contact, hang up immediately. Don’t try to engage the caller in conversation (and don’t fear being rude by hanging up!).

Resources

If you still get a paper check, switch now to avoid missing payments. If you need assistance:

- SSA (benefits, questions): 1-800-772-1213 (TTY 1-800-325-0778)

- My Social Security (set or change direct deposit online): ssa.gov/myaccount

- Go Direct® (Treasury enrollment): 1-877-874-6347 or GoDirect.gov

- Go Direct FAQs: GoDirect.gov/gpw/faq

- Direct Express® enrollment and help: 1-800-333-1795 (enrollment) or the cardholder support information on the back of your card

Article completed with the assistance of ChatGPT. Information verified and supplemented. Copy edited for clarity.