If you have a beloved Fido or Fluffy, you should consider putting your pets in your estate plan. Richard Eisenberg of Kiplinger’s Personal Finance explains why.

When actress Diane Keaton died last year, she reportedly left her golden retriever, Reggie, around $5 million through a pet trust. While the amount may seem like the kind of over-the-top gesture only a celebrity might make, experts say taking steps to ensure a beloved pet will be cared for if you die or become incapacitated is a gift of love.

“If you have no plan, you’re really leaving your pet’s fate up to chance,” says Vicki Stevens, director of program management and communications for the companion animals department of the nonprofit Humane World for Animals.

Yet while a Pew survey found that 97% of owners consider their pets to be part of their family, only half of those with estate plans have specified who would care for their animal companions if they’re unable to, according to FreeWill, an online estate-planning service. When an owner doesn’t make arrangements in advance, the pet can wind up in a shelter rather than a permanent home.

Here’s how to save your animal pal from that fate.

How to put pets in your estate plan

Name your successor.

Identify a friend or relative who can take over as your pet’s caregiver in case you become incapacitated or upon your death, either informally via a verbal agreement. Or, to better ensure your wishes will be followed, get a written, legal arrangement, such as a will or pet trust.

Look for someone whose personality would be a good match for your pet and who would have both the time and an appropriate home. Naming a backup is also a smart idea.

“Double-check on a yearly basis and say, ‘If something happens to me, are you still able to take care of my pet?’” says Stevens. “Encourage people to be honest, so you have time to make alternate plans.”

Set aside money for care.

Allocate funds via your will or a pet trust to help cover the caregiver’s costs, such as pet food and vet bills. The amount depends on your financial circumstances and your pet’s specific needs (on average, pet owners spend $1,700 a year on dogs and cats), as well as your pet’s age and life expectancy.

“If your cat is 2, you might leave a lot more money than if your cat is 15,” said Allison Tait, a University of Richmond law professor.

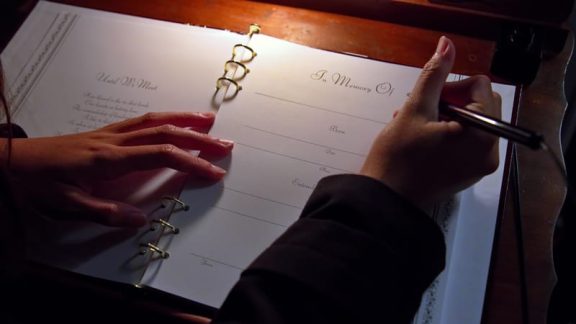

Make it legal.

You cannot leave money directly to a pet in your will. Instead, you leave the animal, which is considered property, to the person you want to care for it, along with instructions and, ideally, a bequest to cover costs.

That’s stronger protection than a verbal agreement but no guarantee your wishes will be followed, says Ronald Siegel, of the Brinkley Morgan law firm in Boca Raton, Fla. A will also can’t address your pet’s care if you become incapacitated.

That’s why experts instead recommend setting up a pet trust, which allows you to name the caregiver, allocate funds for care, specify how the money should be spent, and identify a person or organization to receive any remaining funds when your pet dies.

Lawyers include the cost as part of their estate-planning fee; online wills and trusts run about $100 to $300.

Can’t think of a suitable caregiver? Authorize your executor to use funds from your estate to find a home. One option: Some pet sanctuaries, which are havens for rescued or neglected animals, find owners to “rehome” animals, typically for $50 to $250. Find one at the Global Federation of Animal Sanctuaries.

Richard Eisenberg is a contributing writer at Kiplinger Personal Finance magazine. For more on this and similar money topics, visit Kiplinger.com.

©2026 The Kiplinger Washington Editors, Inc. Distributed by Tribune Content Agency, LLC.

Read more about estate planning on Seniors Guide:

Fairness in Estate Planning